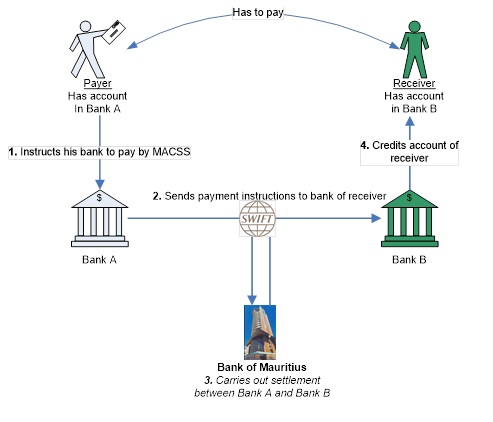

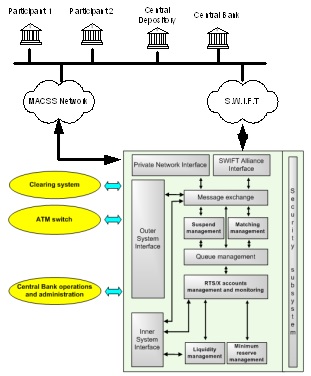

The Mauritius Automated Clearing and Settlement System (MACSS) is an arrangement which allows funds to be transferred between two counterparties immediately and without risk. MACSS can be used to send funds from any account with a commercial bank to any other account maintained with a commercial bank in Mauritius as shown in the diagram below:

MACSS is owned and operated by the Bank of Mauritius and is the country’s only large value payment system. Payments are settled through commercial banks’ accounts held with the Bank of Mauritius in real time on a gross basis, that is, on a transaction-by-transaction basis in real time. Each payment can thus be considered final and irrevocable as soon as settlement takes place. With MACSS, users can make and receive payments with certainty in a faster manner without the risks which are associated with payment by cheques.

The CDS is operated by the Stock Exchange of Mauritius and allows delivery versus payment of stock exchange transactions on a T+3 rotating basis via the MACSS.

The CNP is operated by the Mauritius Network Services (MNS) and is used by the Mauritius Revenue Authority (MRA) for collection of Government taxes. The final settlements are done through the MACSS at the Central Bank which maintains the accounts of the Government.

The operations of MACSS and obligations of its participants are governed by the MACSS Participant Procedures and the Terms and Conditions of MACSS.