Climate change and environmental degradation have emerged as a major concern worldwide and central banks are increasingly initiating measures to tackle the financial risks associated with them.

The Bank of Mauritius (Bank) recognises that climate-related and environmental risks can have important economic consequences that may pose risks to the safety and soundness of financial institutions and hence the stability of the financial system.

In this connection, the Bank took the following initiatives as from early 2020.

- In January 2020, the Bank conducted a survey among banks to ascertain their level of preparedness in respect of climate related risks.

- In July 2020, the Bank joined the Network of Central Bank and Supervisors for Greening the Financial System.

- In June 2021, the Bank released a Guide for the Issue of Sustainable Bonds.

- In September 2021, the Bank issued a draft Guideline on Climate-related and Environmental Financial Risk Management to banks and non-bank deposit taking institutions for consultation.

- On 14 October 2021, the Bank launched its Climate Change Centre.

The Climate Change Centre has, inter alia, the following objectives:

- To integrate climate-related and environmental financial risks into the Bank’s regulatory, supervisory and monetary policy frameworks;

- To review the Bank’s internal operations in view of reducing its carbon footprint and becoming a more sustainable organisation;

- To look into enhancing disclosures on climate-related and environmental financial risks;

- To support the development of sustainable finance;

- To build capacity and raise awareness for climate-related and environmental financial risks; and

- To bridge data gaps in relation to climate-related and environmental financial risks.

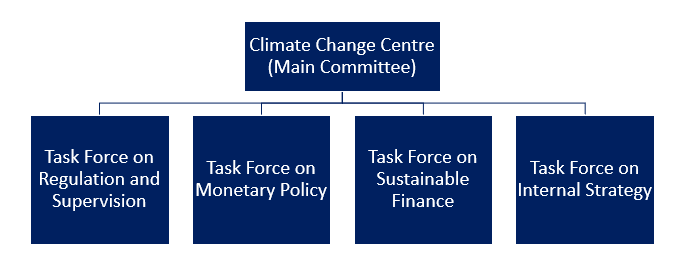

The Climate Change Centre consists of a main Committee, under the Chairmanship of the Second Deputy Governor, with four Task Forces.

Climate Change Centre - Task Force on Regulation and Supervision

The Task Force is chaired by the Second Deputy Governor of the Bank and comprises representatives of the Bank, the Financial Services Commission (Commission), the Mauritius Bankers Association Limited, selected banks licensed by the Bank and selected insurance companies licensed by the Commission. The Task Force may co-opt specialist resources as and when required.

The Task Force will, inter alia, focus on the development of the regulatory and supervisory framework for climate-related and environmental financial risks and look into enhancing disclosure requirements and bridging data gaps for these risks.

Climate Change Centre - Task Force on Monetary Policy

The Task Force will be chaired by the Director of the Economic Analysis and Research and Statistics Department of the Bank and will comprise staff of the Bank. The Task Force may co-opt resource persons representing specific interests as and when required.

The Task Force will, inter alia, assess the impact of climate-related and environmental developments on the monetary policy transmission channels and on the monetary policy strategy as well as integrate climate-related and environmental considerations in the Bank’s investment portfolios.

Climate Change Centre - Task Force on Sustainable Finance

The Task Force will be chaired by the Assistant Director of the Financial Markets Operations Division of the Bank and will comprise staff of the Bank as well as representatives of relevant stakeholders. The Task Force may co-opt resource persons representing specific interests as and when required.

The Task Force will, inter alia, support the development of sustainable finance and promote the implementation of disclosures on climate-related and environmental financial risks.

Climate Change Centre - Task Force on Internal Strategy

The Task Force will be chaired by the Acting Secretary of the Bank of Mauritius and will comprise staff of the Bank.

The Task Force will, amongst others, work on reviewing the Bank’s internal operations in view of reducing its carbon footprint and becoming a more sustainable organisation.