Page 41 - May 2017

P. 41

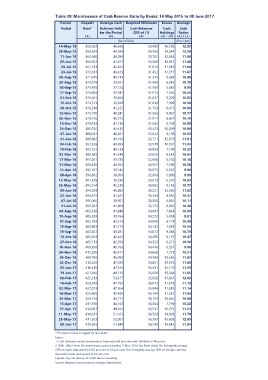

Table 30: Maintenance of Cash Reserve Ratio by Banks: 14 May 2015 to 08 June 2017

Period Deposit Average Cash Required Minimum Excess Average

Ended

Base* Balances Held Cash Balances Cash Cash

14-May-15 (1) for the Period CRR of (1)

28-May-15 (3) Holdings Ratios

11-Jun-15 (2) (2) - (3) (2) / (1)

25-Jun-15

(Rs million) (Per cent)

09-Jul-15

23-Jul-15 360,583 46,626 30,490 16,136 12.93

06-Aug-15

20-Aug-15 360,839 44,584 30,540 14,044 12.36

03-Sep-15

17-Sep-15 363,990 43,596 30,762 12,834 11.98

01-Oct-15

15-Oct-15 366,822 41,817 30,989 10,827 11.40

29-Oct-15

12-Nov-15 367,513 42,622 31,012 11,610 11.60

26-Nov-15

10-Dec-15 372,017 43,423 31,452 11,971 11.67

24-Dec-15

07-Jan-16 371,015 40,739 31,375 9,364 10.98

21-Jan-16

04-Feb-16 373,079 39,921 31,486 8,435 10.70

18-Feb-16

03-Mar-16 373,495 37,120 31,503 5,616 9.94

17-Mar-16

31-Mar-16 374,694 39,541 31,615 7,926 10.55

14-Apr-16

28-Apr-16 375,061 39,866 31,637 8,229 10.63

12-May-16

26-May-16 374,723 39,628 31,630 7,998 10.58

09-Jun-16

23-Jun-16 376,516 41,225 31,753 9,471 10.95

07-Jul-16

21-Jul-16 379,198 40,841 31,960 8,881 10.77

04-Aug-16

18-Aug-16 378,726 40,512 31,911 8,601 10.70

01-Sep-16

15-Sep-16 379,613 41,738 31,945 9,793 10.99

29-Sep-16

13-Oct-16 385,926 42,432 32,423 10,009 10.99

27-Oct-16

10-Nov-16 388,011 40,821 32,622 8,198 10.52

24-Nov-16

08-Dec-16 388,882 45,150 32,771 12,379 11.61

22-Dec-16

05-Jan-17 391,328 43,969 32,978 10,991 11.24

19-Jan-17

02-Feb-17 392,151 40,133 33,029 7,104 10.23

16-Feb-17

02-Mar-17 389,582 41,443 32,826 8,618 10.64

16-Mar-17

30-Mar-17 391,061 39,738 32,988 6,750 10.16

13-Apr-17

27-Apr-17 390,836 40,555 32,957 7,598 10.38

11-May-17

25-May-17 392,107 39,142 33,075 6,067 9.98

08-Jun-17

390,382 38,858 32,968 5,890 9.95

391,338 39,239 33,013 6,226 10.03

392,164 42,230 33,082 9,148 10.77

394,059 45,806 33,221 12,586 11.62

395,875 41,467 33,436 8,030 10.47

395,085 39,957 33,356 6,601 10.11

399,567 41,808 33,772 8,036 10.46

402,638 41,848 34,005 7,844 10.39

405,533 39,766 34,272 5,494 9.81

402,794 42,214 34,040 8,174 10.48

403,903 41,775 34,142 7,633 10.34

402,467 43,081 34,012 9,068 10.70

405,653 42,462 34,295 8,167 10.47

405,713 42,594 34,323 8,271 10.50

408,350 40,766 34,476 6,291 9.98

411,280 42,411 34,688 7,723 10.31

408,765 45,050 34,485 10,565 11.02

413,245 47,939 34,861 13,078 11.60

418,410 47,510 35,331 12,179 11.35

421,645 49,110 35,606 13,504 11.65

425,213 53,677 35,826 17,851 12.62

428,319 47,750 36,072 11,678 11.15

427,073 47,564 35,946 11,618 11.14

429,406 47,406 36,144 11,261 11.04

429,154 46,771 36,129 10,642 10.90

431,978 44,163 36,364 7,799 10.22

434,097 48,812 36,537 12,275 11.24

434,211 51,165 36,563 14,603 11.78

431,553 52,001 36,393 15,608 12.05

433,505 51,344 36,530 14,815 11.84

* The deposit base is lagged by two weeks.

Notes:

1. Cash balances consist exclusively of balances held by banks with the Bank of Mauritius.

2. With effect from the maintenance period starting 2 May 2014, the Bank raised the fortnightly average

CRR on rupee deposits from 8.0 per cent to 9.0 per cent. The fortnightly average CRR on foreign currency

deposits remain unchanged at 6.0 per cent.

Figures may not add up to totals due to rounding.

Source: Research and Economic Analysis Department.